Most employers need a Labour Market Impact Assessment (LMIA) before they can hire a temporary foreign worker. Before the hiring process begins, you must first determine if you need an LMIA or if an LMIA exemption applies.

A full list of work permit and LMIA exemptions can be found below.

An LMIA is a legal document assessing the potential impact of a Canadian employer hiring foreign workers. The reason that an LMIA exists is to make sure that jobs in Canada are made available to Canadian citizens or permanent residents first. Employers, in most circumstances, can only hire an international worker/ employee if they have a positive LMIA confirming that:

- there is a need for a temporary foreign worker.

- no Canadians or permanent residents are available to do the job.

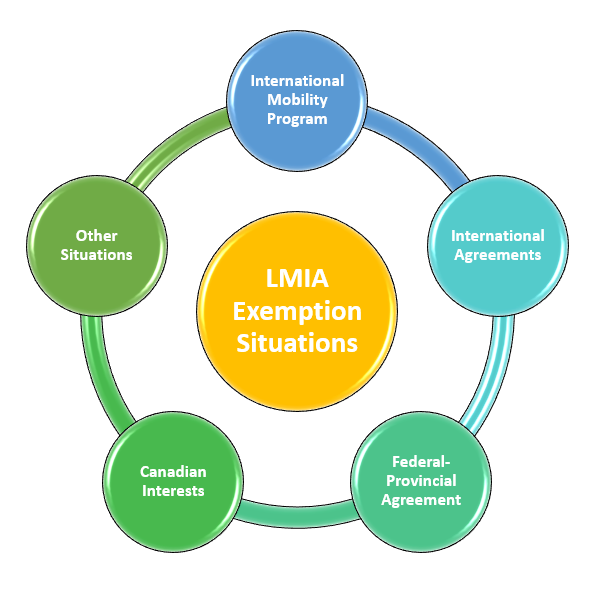

However, there are several situations where an LMIA exemption might apply. If a Canadian employer is exempted from obtaining an LMIA, they can hire a temporary foreign worker without first applying for an LMIA.

International Mobility Program

The International Mobility Program is designed to allow Canadian employers to hire temporary foreign workers without the need to obtain a Labour Market Impact Assessment.

In most cases, for your business to hire a temporary worker through the International Mobility Program, you must:

- pay the employer compliance fee of CAD $230; and

- create and submit an offer of employment form through the Employer Portal. Your offer of employment must include information about:

- your business

- the foreign worker you would like to hire

- the job details

- wage and benefits

Note: Foreign workers will usually still need to submit an application for a work permit, even if their employers benefit from being able to get a LMIA exemption.

International Agreements

You may be exempt from needing an LMIA if your situation is covered by one or more international agreements between Canada and your country. Examples of international agreements which provide an LMIA exemption include the following:

- North American Free Trade Agreement (NAFTA)

- Canada-Chile FTA / Canada-Peru FTA / Canada-Colombia FTA / Canada-Korea FTA

- Canada-European Union Comprehensive Economic and Trade Agreement (CETA)

- General Agreement on Trade in Services (GATS)

Federal-Provincial Agreements

Under Canada’s constitution, responsibility for immigration is shared between the federal and provincial/territorial governments.

The federal, provincial and territorial governments meet regularly in order to develop policy and consult each other on immigration issues. In addition, Immigration, Refugees, and Citizenship Canada (IRCC) has agreements with provinces and territories on how they share responsibility for immigration.

Each agreement is negotiated separately with each province or territory in order to address their unique needs and priorities. If an employer is located in a province which has an agreement in place with the federal government, they may be able to benefit from a LMIA exemption when looking to hire a foreign worker.

For example, individuals who are applying for a work permit under the Atlantic Immigration Pilot Program are exempted from also needing to get an LMIA due to the existence of an agreement between the Atlantic provinces (Prince Edward Island; New Brunswick; Nova Scotia; Newfoundland and Labrador) and the federal government.

Canadian Interests

Certain classes of worker are exempt from LMIA requirements if it has been pre-determined that it is the interests of Canada or a particular territory/province to grant such an LMIA exemption. For example:

Significant benefit – if your employer can prove you will bring an important social, cultural, and/or economic benefit to Canada. This can include:

- general: self-employed engineers, technical workers, creative and performing artists, etc.

- workers transferred within a company (intra-company transferees with specialized knowledge) – only those that will benefit Canada with their skills and experience

- workers under Mobilité francophone

Reciprocal employment – lets foreign workers get jobs in Canada when Canadians have similar opportunities in other countries

- General (such as professional coaches and athletes working for Canadian teams)

- International Experience Canada – a work abroad program for youth and young professionals

- People in exchange programs like professors and visiting lecturers

Public policy & ‘designated by the Minister’

- Academics, including researchers, guest lecturers and visiting professors (sponsored through a recognized federal program)

- Competitiveness and public policy

- medical residents and fellows

- post-doctoral fellows and people who have won academic awards from Canadian schools

Charity and religious work (not including volunteers)

LMIA exemption codes – Full List

IMPORTANT: This list is provided as a guide only. Exemption categories and exemption codes are subject to change at any time by Canadian authorities.

The last major LMIA code updates taken into account below were made on December 15 2022, and were last reviewed by VisaEnvoy in 2024. For the most up-to-date advice on the best category or code to use for your application, please contact a member of our team.

Category: Public Policy – A25.2 exemption codes

| Type of LMIA Exemption | LMIA exemption code |

| Special measures for Hong Kong residents coming to Canada | R01 (in Canada)

R02 (outside Canada) |

| Open work permits for applicants for the temporary to permanent resident pathway | R01 (in Canada)

R02 (outside Canada) |

Category: International Agreements/International Arrangements – R204(a) exemption codes

| Type of LMIA Exemption | LMIA exemption code |

| Non-trade agreements covering airline personnel (ground, technical and operational) and US government personnel | T11 |

| Canada-United States-Mexico Agreement (CUSMA) Traders | T34 |

| CUSMA Investors | T35 |

| CUSMA Professionals | T36 |

| CUSMA Intra-company transferee executives/senior managers | T37 |

| CUSMA Intra-company transferee with specialized knowledge | T38 |

| Colombia Traders | F10 |

| Colombia Investors | F11 |

| Colombia Professionals/Technicians | F12 |

| Colombia Intra-company transferee executives/senior managers | F13 |

| Colombia Management trainees | F14 |

| Colombia Intra-company transferee with specialized knowledge | F15 |

| Colombia Spouses | T25 |

| Chile Traders | F20 |

| Chile Investors | F21 |

| Chile Professionals | F22 |

| Chile Intra-company transferee executives/senior managers | F23 |

| Chile Intra-company transferee with specialized knowledge | F24 |

| South Korea Traders | F30 |

| South Korea Investors | F31 |

| South Korea Contract service suppliers/independent professionals | F32 |

| South Korea Intra-company transferee executives/senior managers | F33 |

| South Korea Intra-company transferee management trainees | F34 |

| South Korea Intra-company transferee with specialized knowledge | F35 |

| South Korea Spouses | F36 |

| Panama Professionals or technicians | F42 |

| Peru Traders | F50 |

| Peru Investors | F51 |

| Peru Professionals or technicians | F52 |

| Peru Intra-company transferee executives/senior managers | F53 |

| Peru Intra-company transferee management trainees | F54 |

| South Korea Intra-company transferee with specialized knowledge | F55 |

| GATS Professionals | T33 |

| EU Traders | T46 |

| EU Contractual service suppliers | T47 |

| EU Engineering technologists/scientific technologists | T48 |

| EU Independent professionals | T43 |

| EU Intra-company transferee executive/senior manager | T44 |

| EU Intra-company transferee Graduate trainee | T42 |

| EU Intra-company transferee with specialized knowledge | T41 |

| EU Spouses of intra-company transferees (T44, T42, T41) | T45 |

| CPTPP Investors | T50 |

| CPTPP Intra-company transferee executive/senior manager | T51 |

| CPTPP Intra-company transferee management trainee | T54 |

| CPTPP Intra-company transferee with specialized knowledge | T55 |

| CPTPP Intra-company transferee professional/technician | T52 |

| CPTPP Spouses | T53 |

| UK Independent professionals | F60 |

| UK Intra-company transferee executive/senior manager | F61 |

| UK Intra-company transferee management trainee | F62 |

| UK Intra-company transferee with specialized knowledge | F63 |

| UK Spouses of intra-company transferees (F61, F62, F63) | F64 |

| UK Investors | F65 |

| UK Contractual service suppliers | F66 |

| UK Engineering/scientific technologists | F67 |

Category: Canada-provincial/territorial exemption codes – R204(c)

| Type of LMIA Exemption | LMIA exemption code |

Canada-provincial/territorial, e.g.

|

T13 |

| Atlantic Immigration Pilot Program | C18 |

| Quebec investors holding ‘notice of intent to select’ | T10 |

Note: There are currently no exemption codes for approved provincial/territorial-international agreements (R204(b) exemption codes).

Category: Canadian interests – significant benefit exemption codes – R205(a)

| Type of LMIA Exemption | LMIA exemption code |

Unique work situations – General:

|

C10 |

Unique work situations – Entrepreneurs/self-employed business owners:

|

C11 |

| Provincial business candidates/Quebec self-employed with a Quebec Selection Certificate (QSC) | C60 |

| Intra-company transferees to an existing business in Canada – executives, senior or functional managers

AND Airline personnel (station managers) |

C62 |

| Intra-company transferees with specialized knowledge | C63 |

| Intra-company transferees starting a branch or affiliate in Canada | C61 |

| Emergency repair personnel for out-of-warranty equipment | C13 |

| Essential workers for the production of TV or film | C14 |

| Rural and Northern Immigration Pilot | C15 |

| Rural and Northern Immigration Pilot – Spouses | C17 |

| Francophone mobility | C16 |

| Live-in caregivers with a submitted permanent residence application | A71 |

| Caregivers who have submitted a permanent residence application under the Home Child Care Provider Pilot or Home Support Worker Pilot | C90 |

| Spouses and adult dependants of caregivers who have submitted a perment residence application under the Home Child Care Provider Pilot or Home Support Worker Pilot | C91 |

| Certain Quebec Selection Certificate (CSQ) holders who are currently located in Quebec | A73 |

| Public policy for spouse or common-law partner in Canada or family class applicants | A74 |

| Bridging open work permits (BOWP) | A75 |

Permanent resident facilitation work permit categories:

|

A75 |

| Quebec Selection Certificate (QSC) holders who are currently located outside Quebec | A76 |

| Start-up business class (SUV) permanent resident visa applicants | A77 |

Category: Canadian interests – reciprocal employment exemption codes – R205(b)

| Type of LMIA Exemption | LMIA exemption code |

| Fishing guides (border lakes)

AND United States government personnel (family members) |

C20 |

| Residential summer camp counsellors | C24 |

| Coaches and athletes | C26 |

| International Experience Canada Program | C21 |

| Academic exchanges (professors, visiting lecturers) | C22 |

| Performing arts | C23 |

Category: Canadian interests – research exemption codes – R205(c)(i)

| Type of LMIA Exemption | LMIA exemption code |

| Research | C31 |

| Educational co-op – post-secondary level | C32 |

| Educational co-op – secondary level | C33 |

Category: Canadian interests – competitiveness and public policy exemption codes – R205(c)(ii)

| Type of LMIA Exemption | LMIA exemption code |

| Spouses/common-law partners of high-skilled workers (TEER levels 0-3) | C41 |

| Spouses/common-law partners of full-time students | C42 |

| Post-grad employment (PGWP) | C43 |

| Post-doctoral Ph.D. fellows | C44 |

| Medical/dental residents and medical research fellows | C45 |

| Dependent children of a high-skilled worker (TEER levels 0-3) | C46 |

| Spouses/common-law partners of low-skilled workers (TEER levels 4 and 5) | C47 |

| Dependent children of a low-skilled worker (TEER levels 4 and 5) | C48 |

| Family members of economic class permanent residence applicants | C49 |

| Academic award recipients | C52 |

| Innovation stream pilot | C88 |

Category: Canadian interests – charitable or religious work exemption codes – R205(d)

| Type of LMIA Exemption | LMIA exemption code |

| Religious work | C50 |

| Charitable work | C51 |

| Educational co-op – secondary level | C33 |

Category: No other means of support – R206 exemption codes

| Type of LMIA Exemption | LMIA exemption code |

| Refugee claimants | S61 |

| Persons under an unenforceable removal order | S62 |

Category: Permanent residence applicants in Canada – R207 exemption codes

| Type of LMIA Exemption | LMIA exemption code |

| Live-in caregiver class (LCP)

Spouse/common-law partner in Canada class (eligibility passed) Protected persons under subsection A95(2) Section A25 exemption on humanitarian and compassionate grounds Family members of any of the above |

A70 |

Category: Vulnerable workers – R207.1 exemption codes

| Type of LMIA Exemption | LMIA exemption code |

| Vulnerable workers | A72 |

| Family members of vulnerable workers | A72 |

Category: Humanitarian reasons – R208 exemption codes

| Type of LMIA Exemption | LMIA exemption code |

| Destitute students | H81 |

| Holders of a temporary resident permit which is valid for at least six months | H82 |

Work permit exemptions

Individuals in the following categories are typically exempt from requiring a work permit in Canada.

- R186(a)—Business visitors

- R186(b)—Foreign representatives and R186(c)—Family members of foreign representatives

- R186(d)—Military personnel

- R186(e)—Foreign government officers

- R186(f)—On-campus employment

- R186(g)—Performing artists

- R186(h)—Athletes and team members

- R186(i)—News reporters, media crews

- R186(j)—Public speakers

- R186(k)—Convention organizers

- R186(l)—Religious leaders

- R186(m)—Judges, referees and similar officials

- R186(n)—Examiners and evaluators

- R186(o)—Expert witnesses or investigators

- R186(p)—Health care students

- R186(q)—Civil aviation inspector

- R186(r)—Aviation accident or incident inspector

- R186(s)—Crew (international transportation)

- R186(t)—Emergency service providers

- R186(u)—Implied status

- R186(v)—Off-campus work

- R186(w)—Off-campus work (transition to post-graduation status)

- R186(x)—Registered Indians

- Assessing farm work

- Public Policy: Short-term work permit exemption

- Public Policy: 120-day work permit exemption for researchers

In addition to the above profession and policy-based exemptions, registered Indians (as defined under the Indian Act), are also exempt from having to apply for a work permit.

Kunal Thakur

Regulated Canadian Immigration Consultant R#519955

Kunal Thakur is a passionate Regulated Canadian Immigration Consultant (RCIC) with close to two decades of immigration experience, during which he has successfully guided thousands of people on their immigration journey. He is quick in responding to client queries and constantly strives to give his clients the best possible advice. Kunal brings immense value to our team with his talks and discourses on immigration. When not in front of his laptop reading and analysing client cases, he enjoys spending his spare time exploring new places and trying new things. Kunal is currently based in Adelaide, Australia. You can book a time with him here.